Scam calls are now the most common crime in the UK. We have all had scam calls and it can be hard to tell the difference between a scam and a legitimate phone call. With scam calls getting more and more frequent it's important to know some of the typical tricks that scammers use so you can be prepared.

Bank scams - Someone may call you claiming to be from your bank telling you there’s a problem with your card or account. The caller will often sound professional and try to convince you that your card has been cloned or that your money is at risk. They may ask you for your account and card details, including your PIN, and even offer to send a courier to collect your bank card! They may also advise transferring your money to a ‘safe account’ to protect it, which would be the scammer's account. This is a common scam and your bank would never ask you to do this.

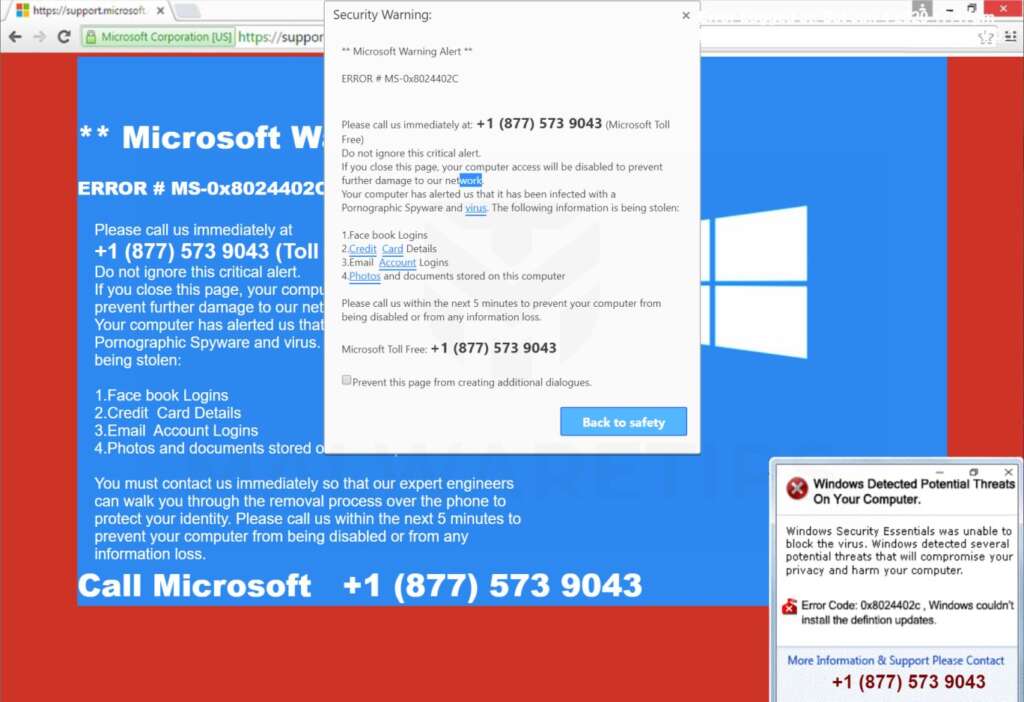

Computer Repair scams - Hello sir/ madam, I’m calling you from Microsoft. Does this sound familiar? This is possibly the most common type of scam call. The caller will tell you that your computer has a virus and will ask you to download ‘anti-virus software’, possibly at a cost. The software they ask you to download is spyware software which is used to get your personal details. It is important to remember that Microsoft NEVER calls anyone, other legitimate IT companies also don’t contact customers this way.

HMRC scams - You may get a call from someone claiming to be from HMRC saying there is an issue with your tax refund or an unpaid tax bill. They may leave a message and ask you to call back. Again, don’t be fooled by this. HMRC would never contact you this way and would never ask you to reveal personal financial information such as your bank account details.

Compensation calls - This is a call from a company asking about a car accident you’ve supposedly had claiming you may be entitled to compensation. Some of these could be genuine companies looking for business but others are scammers. Don’t engage in these calls. If you’ve had an accident, call your own insurance company on the phone number provided on your policy.

‘Anti-Scam’ scams - This is a call from someone claiming to be from a charity supporting scam victims, a company selling anti-scam technology, or from someone demanding money to renew your Telephone Preference Service registration, which is free.

Other popular scams to be aware of are, Number Spoofing scams which are new technology scammers use to mimic an official telephone number so it comes up on your caller ID display. Pensions and Investment scams, nuisance calls about pensions are now illegal. If you receive a call about your pension, report it straight away. Pop-Up scams are webpages that pop up with either loud beeps or a voice that ask you to call the number provided because your computer has been damaged. Be alert to all of these.

The BBC showed scammers at work in an Indian call centre, recorded by an activist who hacked into the hacker's security cameras. The scammers were seen laughing at their victims in the US and the UK. Click the video below to watch:

What should I do if I get a scam call? Older people are often the biggest target for scammers, also people who have been successfully scammed before are at a much greater risk of being scammed again because the scammers now know you’re an easy target. It’s important to be aware of phone scams and how to handle them. Fortunately, there are things you can do to protect yourself:

Don’t reveal personal details – Never give out personal or financial information (such as your bank account details or your pin) over the phone, even if the caller claims to be from your bank. Most callers will also ask you to log into your online bank account on your computer, which you should never do.

Hang up – If you feel harassed or intimidated, or if the caller talks over you without giving you a chance to speak, end the call. It may feel rude to hang up on someone, but you have the right not to be pressurised into anything. It’s also worth remembering if a scammer was unsuccessful at scamming you they mark you down as unsuccessful, eventually they won't waste any more of their time trying to scam you if you don’t let them.

Ring the organisation – If you’re unsure whether the caller is genuine, you can always ring the company or bank they claim to be from. Make sure you find the number yourself and don’t use the one provided by the caller. Remember, a lot of these legit companies scammers claim to call you from don’t call anyone.

Don’t be rushed – Scammers will try to rush you into providing your personal details. They may say they have a time-limited offer or claim your bank account is at risk if you don’t give them the information they need right away. Remember, if you’re not sure, hang up the call and call the organisation they claim to be from.

What should I do if I’ve been a victim of a scam? Scammers are constantly finding new ways to trick people and phone scams are changing all the time. If you’ve been a victim of a scam don’t be embarrassed to report it, It can happen to anyone. If the scammer had access to your computer, it would be a good idea to take your computer to a computer tech as some scammers try to leave back doors so they can gain access to your computer without you knowing.

Why won't the Indian government do more to stop scam calls from India? Are the scammers really paying them to turn a blind eye? Click the video below to watch:

What should I do next?

Talk to your phone provider to see what privacy services and call-blocking services are available, although you may need to pay for some of these services.

HACKING the online SCAMMERS who tricked us! Click the video below to watch: